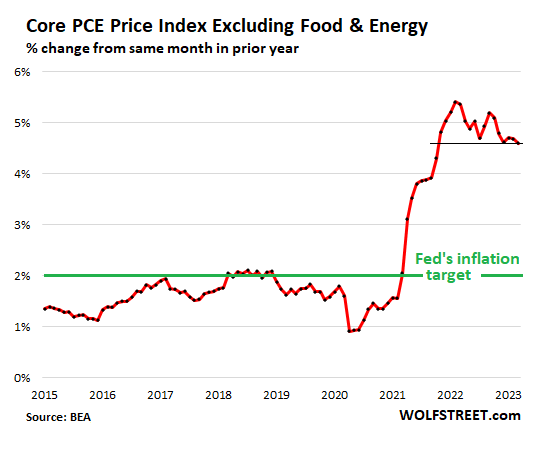

Wolf Richter over at wolfstreet.com observes that “inflation is stuck” in spite of the rate hikes and other measures taken. It doesn’t really go down, but simply shifts from one product category to another, leaving us with a still unsustainably high CPI/PCE (consumer expenditures).

This is really what you'd expect in case deeper structural issues impacting upon the financial economy (e.g. the resource constraints that I'm constantly emphasizing), but we can also add anything from secular cycles in population dynamics (the pensions time bomb) to geopolitical transition events). All of these are not mutually exclusive either.

One example of such geopolitical transition events that may come into play at this time would be the Yen carry trade and its indirect reliance upon the petrodollar wealth pump (the BOJ generates Yen at low interest, and the debtors then purchase high-yielding US securities) in case the reserve status of the USD would be undermined.

... and now, six weeks after the Silicon Valley Bank debacle, the First Republic bank seems to be on the ropes (which means a whole lot of other entities are propped up upon securities that are utter shit) which seems to indicate that there really are no more viable workarounds in terms of the structural destabilization that followed on the heels of the 2007 crisis.

Continued inflation in dollar-denominated asset prices would seem to equate to a slow dollar collapse by definition; and rising interest rates (or worse, another repo crisis and a loss of inter-bank trust) will mean liquidity grinds to a halt with much the same result, although more rapidly.

We also see an unstable situation in terms of commercial real estate all across the West, which at this very moment is getting caught up by the revaluations following in the wake of covid telecommuting solutions. The first sales of prime real estate in San Francisco is seeing a drop in valuation of 75% from the listing price 3-4 years ago. This is immense.

The repercussions of 60-75% drops in real estate valuations means huge losses of on-the-books capital.

In a sense, we're doing 2008 backwards this time. We've already seen losses in the banking sector greater than what was the case then (in total assets being lost), and that was as an immediate consequence of the popped housing bubble.

This time, the yet-ongoing banking crisis will now likely further foment a collapse in an extremely leveraged real-estate bubble significantly larger than fifteen years ago, and with entrenched international linkages (e.g. through sovereign investment funds &c)

Same thing is happening in Sweden in relation to the highly-leveraged SBB:

One important issue to focus on moving forward is the banks’ level of exposure to commercial real estate debt/office loans. This seems to be mainly an issue for regional niche banks, but the number of those affected seems to be large enough to imply domino effects and further mid-level bank failures, even if the supermajors aren’t heavily exposed.

But this also looks like a potential feedback mechanism into the fundamentals of the ongoing banking crisis. The failures beginning to occur about two months ago were due to the constraints on liquidity and the effects on debt servicing (and what this meant for securities based in this debt).

So a sudden drop in market valuations on heavily leveraged commercial real estate (on both sides of the Atlantic) at least seems to carry the potential to aggravate an already unstable financial economy.

Any thoughts?

I wouldn't argue any of this. But here we are a decade and a half after the 2008 crash (sic). And mostly nothing has changed. I can hear voices screaming oh lots has changed, blah blah blah. And they are right , Im sure. On a certain level. The dollar is doomed, eventually. So is the US as global imperialist power....eventually. But i see that eventuality is something like twenty years. The resource question is so loaded and so full of contradictions I hesitate to broach it. I say that because I would argue almost certainly the public is not told the whole story, or maybe any of the story. Electric cars and not sustainable. The grid is already overloaded. My guess is someone, China maybe, musk maybe, or both or others will have found a new lighter battery that uses tangerines or plastic waste to fuel it. Something. But i could be wrong. We are either watching absolutely deranged sociopaths running the asylum, or we are simply not told anything remotely like the truth. And this is a bit how i feel about bourgeois economics. My mind freezes a bit. Why? because in the end the authority structure, the ruling class, will make new rules.

It's looking like the perfect economic storm, isn't it? The ultimate doom spiral as decades worth of stored chickens come home to roost ... a fully charged chicken battery ready to discharge its energy....